Startup Money Ball

Determined not to make the same mistakes as with our first business, we adopted a "money ball" approach to product development and focused on building a profitable business rather than optimizing around a venture raise.

From a business perspective, the first two years of my entrepreneurial career were an epic failure. For most of 2015 and 2016, I spent every night and weekend building our audio sharing community, uTalk (later changed to Wavve). It's hard to think about how much time we invested, and in the end, we decided to liquidate everything we built for pennies on the dollar.

☝️ You can read more about the journey and lessons learned from that failed business in this series of posts.

Changing our Perspective

As we were winding that business down, we found a new market opportunity. Determined not to make the same mistakes as with our first business, we adopted a "money ball" approach to product development and focused on building a profitable business rather than optimizing around a venture raise.

Being "Broke" can be a Superpower

First some background on where I was at that time. I was broke, shouldering a quarter million in student debt, and felt enormous pressure to turn my finances around. I never felt comfortable. If I wasn't working, learning, and building, I was moving backwards. This isn't hyperbole. My loans were negative amortizing and the interest payments were $1600 per month and growing.

In 2015 and 2016, I used holidays and any available PTO from my 9-5 job to work on Wavve. And despite putting in 80 hour work weeks for these two years, my wife and I were just one emergency away from missing our rent payment. We were still living paycheck to paycheck and just trying to keep our heads above water.

By 2017 my income turned a corner as I started earning $120/hour as a contract engineer with Fount. When I started earning all of that money as a contractor, it became extremely difficult to stay motivated pushing Wavve forward. I still believed my best chance for paying down the $250k in student loans would be through owning a software business, so I decided to double down on a new passive-income generating product that we were working on.

I had no savings, access to capital, or family support. My only asset was my time, so I had to be careful in how I balanced the continued investment in Wavve with contract work. This forced me to focus on building this new product with a profit-first mentality.

The 'Money Ball' Approach to Bootstrapping

This time we adopted a more scientific process for deciding what to build and when to build it. That is to say, we evaluated every potential product feature in terms of ROI and would only start building when customers were begging to pay us for it.

The first version of Wavve was a static web page with a dropdown for customers to choose their video design. When a customer paid us, they'd send us their design assets and we'd upload them to the website. Then we'd email them a link to the site's public IP address (that's right, we didn't even have a domain name), so they could choose their design from the dropdown and generate a video.

I taught my business partner, Baird, how to upload images to Amazon S3 and to use git to update the static site's code with a link to the newly uploaded image. This got us by for a few months and our first 20 customers were all onboarded this way. By then we were wasting so much time manually uploading these files that it was worth the investment to build out proper user accounts, database schema, etc...

As we scaled up to 100 customers, we started hitting memory issues on AWS EC2, and every time this happened I'd have to manually access our compute instances and either free up memory or restart them. As our free AWS credits expired, it became more and more important to devote a large share of my time to infrastructure.

With our previous venture, I wasted months modeling data, setting up authentication, user accounts, making infrastructure decisions, and in the end it didn't matter because we never validated that people were willing to pay for our product.

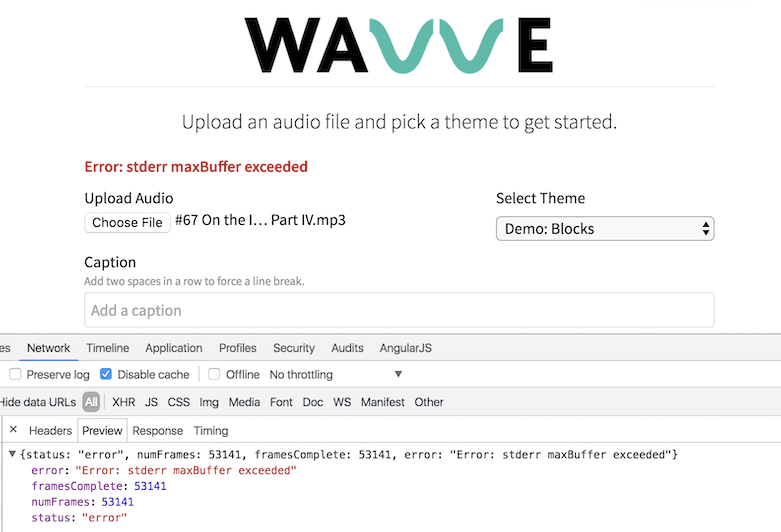

This time around we focused on profit-first. The experience was horribly disjointed, the UI was horrible, video generation regularly failed, and it required a lot of back and forth with each customer, YET customers were willing to overlook those short comings. This was incredible validation that we were on to something big.

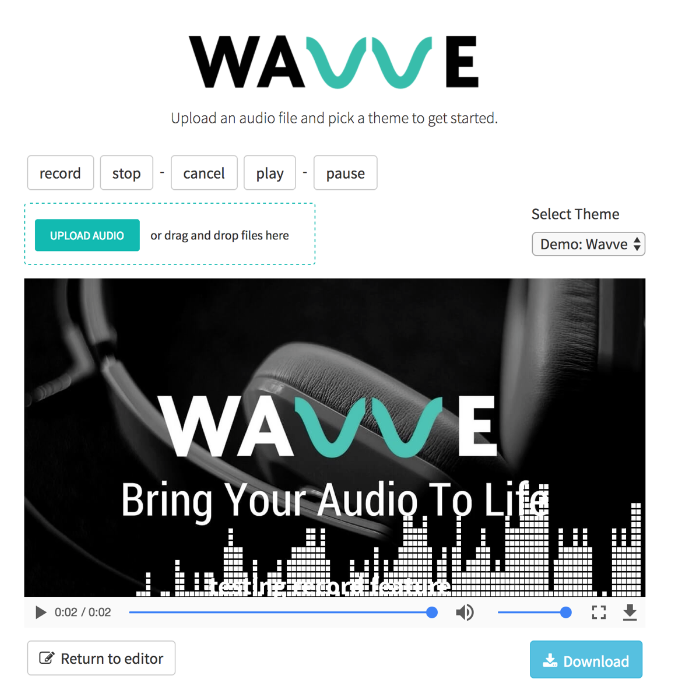

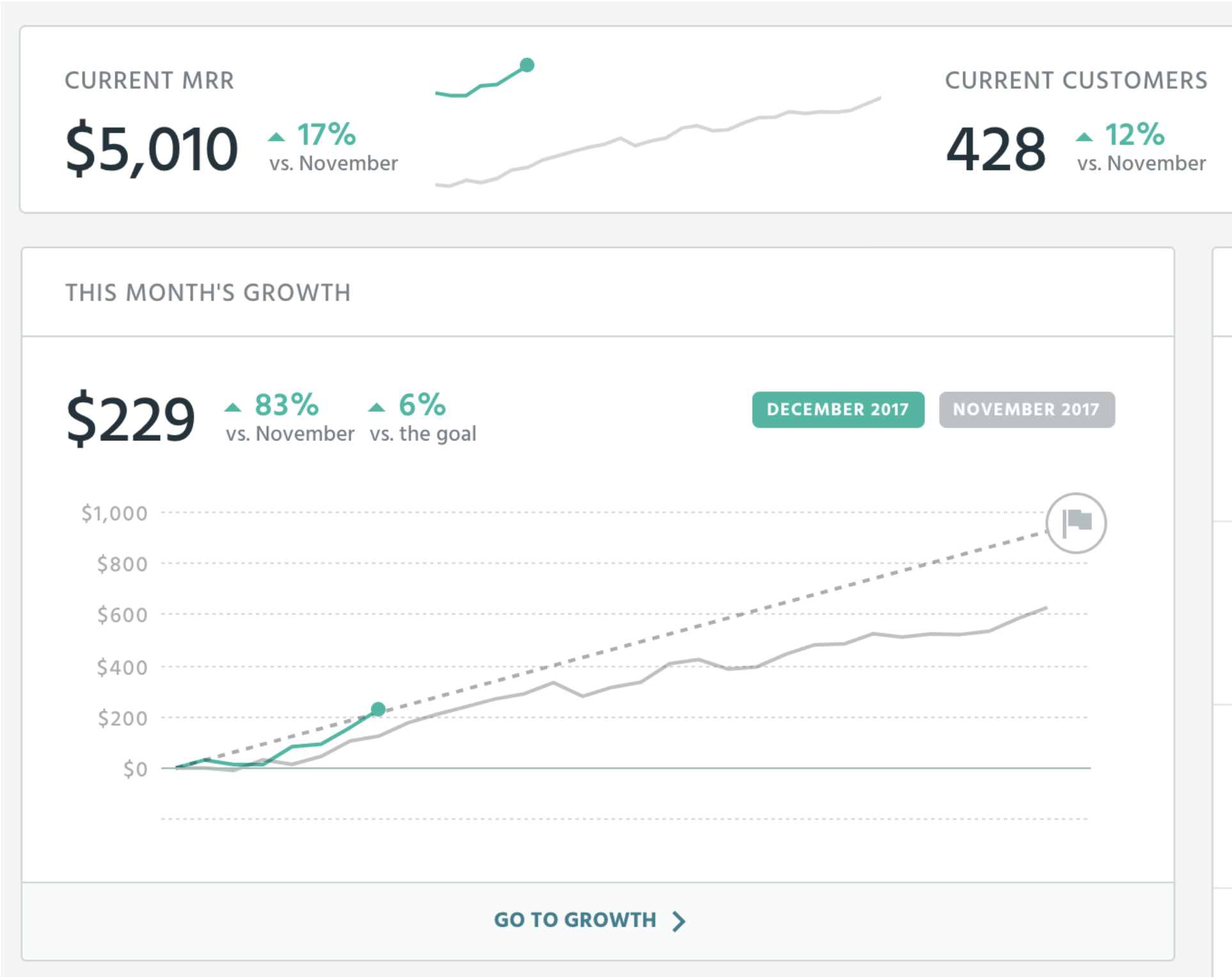

We crossed $1,000 MRR in May 2017, and I decided to go BIG on building a custom editor to make the design experience totally self-serve. This took about a month to build, but all the effort was worth it. From June to the end of the year we grew by 4x.

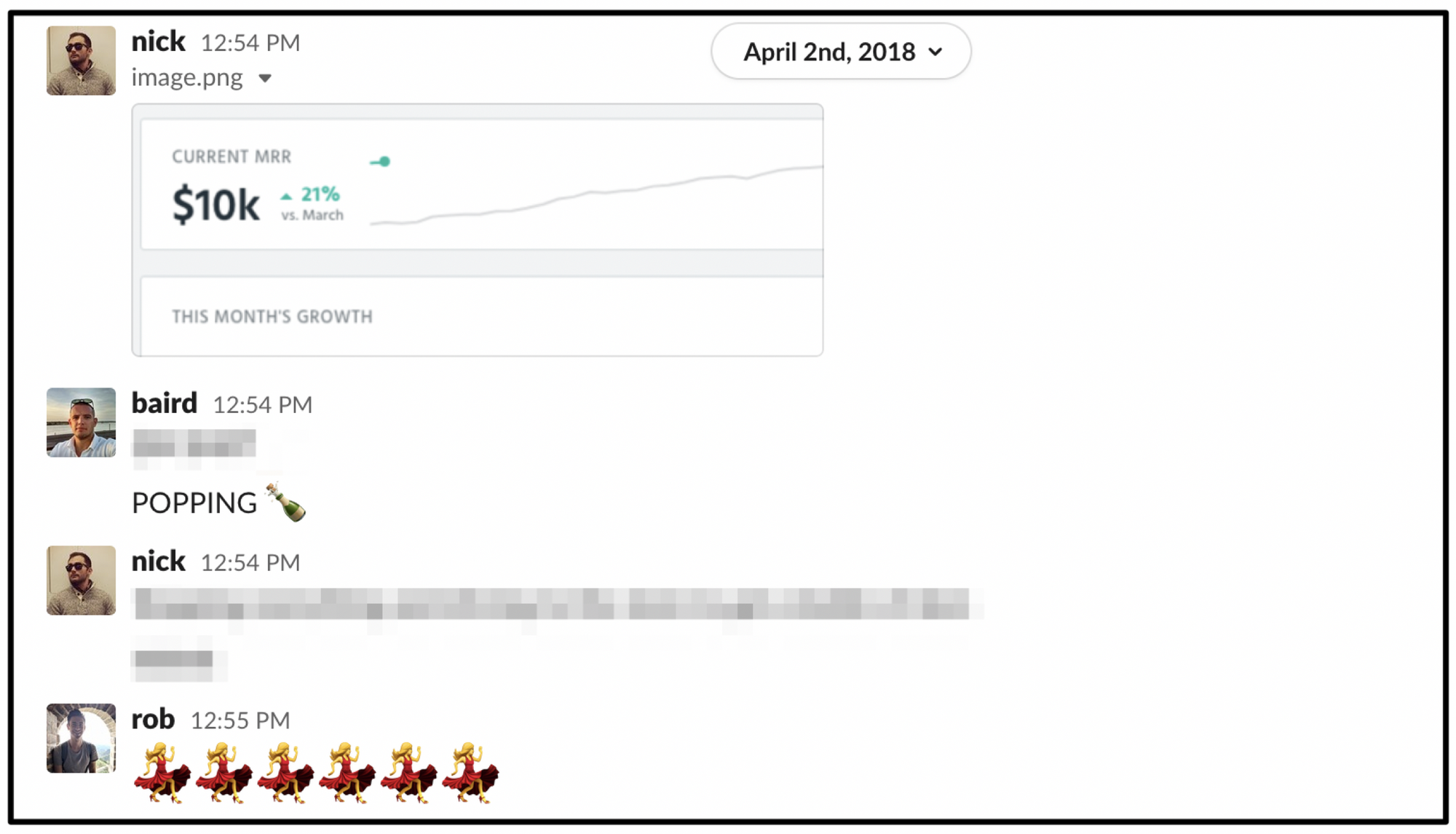

Over the next year we hired a few contractors to help with some quick-hit items, redesigned the front-end to be more usable, and in April 2018 we crossed our goal of $10,000 MRR!

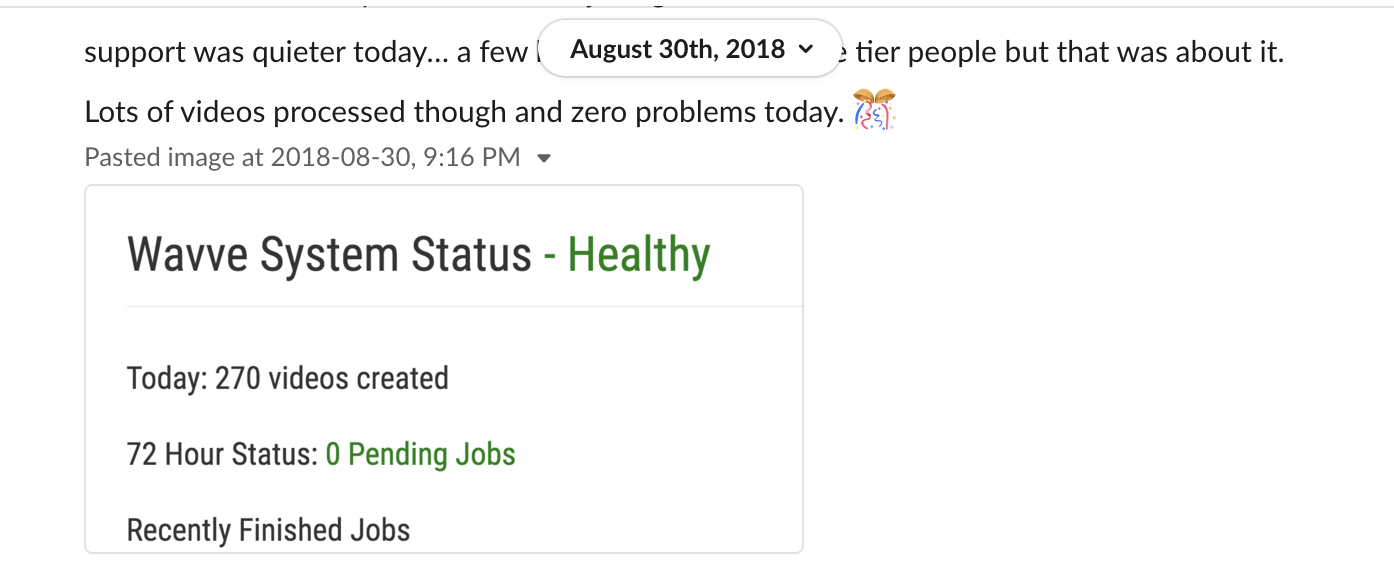

But we were having major issues scaling. We were at about 1,000 customers and servers started running out of memory, the job queue would get backed up, and customers were waiting longer and longer for videos to finish. I'd put off overhauling our old duct-taped backend as long as I possibly could. Now it was impacting customers.

Without getting too bogged down in the technicals, we had 10+ separate compute instances generating all of that video and until now, I'd been able to just add additional instances to onboard the next 50-100 customers. This was getting expensive and it was extremely time-consuming. Every day I was having to access an individual server and perform some kind of maintenance.

We spent two months rewriting our entire backend to use a completely different infrastructure for video generation. This was probably the biggest single investment we made from a technical standpoint and we waited until we were sure there was a positive ROI. It worked. Immediately, our AWS bill decreased by about 50%, video wait times dropped by several minutes, and this freed me up from having to perform daily infrastructure maintenance.

Our early, 'Money Ball' approach was critical to validating the market and reduced the risk that we would build something no one would pay for. As we've continued to grow the last few years, we've enjoyed higher revenue and now have the cash flow to take more calculated risks without obsessing over ROI as much (although we still consider it). If you'd like to know more about our journey and this approach, be sure to check out the series of posts I've written on the topic.

Also, if you found this helpful or just want to reach out with any questions of your own, please connect with me or DM @nickfogle on Twitter.