Bailing Water

In 2008, I traded a difficult situation for a more difficult one - law school and six figures in student loans.

There are 1.2 million people with six-figures of student loan debt and 520,000 who owe more than $200,000. I was in that second group.

Background

This is my story about higher ed, student loans, switching careers, and paying off a quarter million debt. For me, I was looking at $250,000 as recently as Christmas of 2016. I know the crushing weight of this kind of debt and how lonely it can feel to face such a seemingly insurmountable obstacle. Hopefully my story can serve as a cautionary tale to those who aren't yet under a mountain of debt while providing some hope for those who are currently buried under it. Give me a shout on Twitter (@nickfogle) or in the comments if this resonates.

Graduating during a recession

I finished undergrad in 2008 - 3 months after Lehman Collapsed. It was a rough time to be an economics grad looking for a job in banking. I found myself jobless at a time when there were absolutely no jobs. I had a choice, I could either move back in with my parents or continue living on my own as a financially independent adult.

I chose the latter, and ended up taking the only job I could find - unloading trucks and stocking frozen goods at Walmart. This was difficult and sort of humiliating. It wasn't so much that I was embarrassed to be working at Walmart. It was more that I was tired of having to explain myself. "No, I didn't drop out." "Yes, I actually finished a semester early." "No, my parents aren't willing to cover my bills until I find something better."

A few thought it would be fun to go to the front and page me over the intercom. Hilarious. 😤

I started wearing a zip-up jacket so I can could quickly hide my Walmart name tag if I saw a classmate. Then I'd just play it off like I was shopping there and wouldn't have to explain myself.

I Guess I'll Go to Law School

In February, I traded a difficult situation for a worse one. I took the LSAT, and started applying to law schools like my life depended on it. When I received the acceptance letter from Charleston School of Law, I was all in on law school. I’d always dreamed of living in Charleston, and it would soon be a reality. I knew it was an expensive private school, but there were a few things I thought I could do to reduce the overall cost.

First, I planned to work part-time (and enroll in the school's part-time program) to cover my cost of living. Second, I struck a deal with my father where he'd pay off a portion of the loans if I graduated with a certain class rank. Figuring that I could cover all expenses with part-time work and confident that I'd reach the necessary class rank for my dad's help, I calculated a maximum price of $90k.

These assumptions and back-of-the napkin calculations showed my immaturity. Millions of young people approach big decisions around student loans in a similar way. I think part of it stems from being taught that education is always a good investment. And when it comes to being a doctor or lawyer, many just assume that they'll make so much money after graduating, the loans won't really affect their standard of living.

I worked throughout law school while taking classes part-time, and I took the maximum course load each summer to ensure I finished in the standard 3 years. I made sure to check all the important boxes for landing a top job after graduation: editor on law review, moot court winner, graduated in the top 1/4 of my class, etc... By the time graduation came in May of 2012, I was exhausted.

Now it was time to start bar exam prep. After requesting another $5,000 to cover bar study costs, my outstanding loan total was nearly $130,000. This was $40k over my original cost estimate. I failed to fully factor in the cost of living change for Charleston, SC (more than double what I’d paid in Clemson), and I hadn't even considered the impact of student loan interest. A large part of the overage was attributable to 3 years of federal unsubsidized loans with 7.5%-8.5% interest rates.

Where are those high paying law jobs?

Things went down hill after graduation. Even though I met the criteria for the deal I made with my father, he was no longer in a position to help. To make matters worse, the legal job market was still in a deep recession and jobs were few and far between. The firm I’d worked for throughout law school offered me a job and started salary negotiations at $40k. There was no way I could make my loan payments with that kind of pay, so I had to refuse.

I tried to balance bar studying with my job hunt. I reached out to everyone I knew with a family member in the legal field, and tried to set up meetings. I took attorneys to lunch in the hope of making a connection and demonstrating my initiative. I gave up on law jobs in Charleston, and started thinking about Federal jobs. Public loan forgiveness sounded like the best way to get my loans covered, so I bought a book about the secrets to landing a government job and put the book's advice into practice.

I applied to something like 50 jobs with the federal government. Each time I wrote a custom cover letter and targeted resume. I applied for law positions, economics positions, paralegal positions, research positions, literally any role where I met the requirements. I thought my luck was starting to turn when I received an email about a job with the Treasury department.

They were looking for someone with my exact background - economics undergrad with a law degree. I went through several interviews and wrote hand written follow-up letters to the interviewers after each round. Days later, the hiring manager reached out to tell me I was the final candidate. They said they’d be in touch within a few weeks. It's been 8 years now, and I still haven't heard back.

Desperation

August came. The bar exam was behind me. There were no jobs in Charleston, so Brittany and I considered moving. She'd been working at a non-profit and off-handedly mentioned this to her manager, who then used this as grounds to delay her annual pay raise which we desperately needed.

I drove to Columbia and met with attorneys. Then I lined up meetings in Greenville and drove from firm to firm across the upstate. I talked to a judge, a county solicitor, and a number of private practices – I was buying lunch for anyone who would talk to me and trying my best not to come across as desperate. No one had the budget or willingness to take a risk on a new grad. I was running out of money and had to find something soon, so I lowered my standards.

On a scale of desirable legal employment, doc review gigs are at the very bottom. There are no benefits, they're low paying, and they can be cancelled at a moment's notice. I learned about a "coveted" $30 per hour contract gig in Charlotte, so I scheduled an interview and made the drive. The meeting was on an abandoned floor of a downtown high rise and lasted about 5 minutes. They were basically just checking to see if I had a pulse and weren't able to give me any sort of timeline or assurance that contract openings would even become available. I fought back tears as I called my wife on the way home and tried to keep a positive tone, but in that moment I felt utterly hopeless.

We were out of money and my credit cards were maxed out. I tapped out my last card to get a cash advance so September's rent check wouldn't bounce. We were going to need to move somewhere cheaper.

I went into Survival Mode

I posted a housing wanted ad on Craigslist.

We found a nice couple who lived out on a remote part of Johns Island and they were willing to rent us their guest house for $1000 on a month to month basis. We moved all of our belongings into storage. I found a minimum wage job as a shuttle driver on Kiawah Island. After tips I could make something like $13/hr or about $100/day.

Learning to Code

This is when things really started to turn around. Maybe it was the change in scenery and forcing myself to think about something other than law, but I realized I’d lost all interest in pursuing a traditional legal job. I was so sick of the bureaucracy and felt jilted by the system. I’d done all the things that you’re supposed to do, and the system hadn’t rewarded me.

What if I created my own job? I knew I had valuable skills and could do anything I set my mind to, and if others couldn't see that, I would find a way to earn an income from that value myself. I had a business idea, but I needed a designer and a coder. I was beyond broke but naive enough at the startup game to try contacting a few people to see if they'd work in exchange for equity. No one wanted to work for free on an inexperienced founder's idea.

I realized I'd have to start this by myself, which meant I'd need to learn to code... at least enough to get started. We couldn't afford internet so I had to get creative finding public wifi. After my shifts I'd park outside of Starbucks or go to the public library to use free wifi. I used every idle moment to absorb as much as I could. I'd stuff my laptop under the driver seat of the shuttle and in between pickups, I'd continue coding.

Landing an Internship

It took me about six months of obsessively learning as much as I could, before I landed an internship as an interactive designer at Blackbaud. During the first few weeks, I had no idea what I was doing. I got lucky that they took a chance on me, but now that I had a foot in the door, I wasn't going to miss an opportunity to demonstrate my value. I arrived early and worked late every day. At the end of the four month internship, they weren't able to hire me for a full-time role. I was devastated and spent the next few days feeling sorry for myself.

The hardest $1,600 I ever made

At this point I was actually a pretty good web dev, and I was able freelance while applying for jobs. One of my first clients was a small agency downtown. I met the owner for coffee and we had a great conversation about the role. They were looking for a full-time WordPress developer, and I seemed like the perfect fit. It would be a few weeks before they could commit to a hire, and they needed help right away, so I agreed to join their team as a contractor.

They described a "quick-turn, pretty simple Wordpress site" and showed me a few wireframes. It looked like 1-2 weeks of work, so I quoted a flat fee of $2,100. They agreed to my price and wanted to start right away. I was absolutely thrilled. At the time, $2,100 seemed like an unbelievably large amount of money. I went down to their office, met the team, and had a formal interview where we agreed on a salary range and starting date.

Things were really looking up. I called my wife to tell her how it went, and she relayed the news to my in-laws. They scheduled an impromptu celebratory dinner. I didn't have a formal offer letter, but it seemed like a sure thing.

Over the next few weeks, things unraveled spectacularly. After nearly 100 hours of work, payment seemed unlikely and the job was off the table. This was an absolutely horrible experience that almost scared me away from freelancing for good. In the end I had to draft a formal complaint, threaten litigation, and negotiate to recover a portion of my fee. You can read more about this experience and lessons learned in my post about the hardest $1,600 I've ever earned.

This was probably the worst I'd ever felt about myself. I felt utterly hopeless. How hard can it be to get a decent job? I couldn't get a salaried job and now my freelance career felt like a total failure. After years of grinding, learning, and working as hard as I could, I had nothing to show for it.

A Salary and Benefits

The night is always darkest before the dawn.

Out of nowhere, I got a call from the HR department of Blackbaud about coming in for an interview. A colleagues had noticed all my hard work as an intern and referred me for a new job that had just opened up. In October 2013, one year after embarking on this journey, I landed a full-time job with a decent salary, 401k, and full health benefits.

Around the same time, I remember being at an event for my wife’s work and running into an older woman who shared an office suite with my old law firm. She asked me what firm I was with now, and I explained that I was a web developer now. Her mouth dropped and she said something like, "your parents must be so disappointed." This comment cut pretty deep at the time, because I was still self conscious and trying to rationalize my decision to leave law for a career in tech. I'd love to see her again and catch her up on 2020 Nick and what's transpired since leaving law to become a lowly web developer.

I digress.

I started writing this to explain how I got into a $250,000 hole with my student loans. By the time I landed that full time job in 2013, my loans had ballooned to nearly $200,000. I was enrolled in the PAYE (pay as you earn) program which sounded great at the time, but I had no idea it would mean negative amortizing loans. I had my head in the sand and was just wishing the giant mountain of debt would go away if I was a good boy and made my payments each month.

In 2014 I landed a higher paying job at Blackbaud and started taking work on the side as often as I could. At this point I was making a little over $60k per year and had started becoming more aware of how fast my student loans were growing. I met with financial advisor who appeared to be shocked when I shared my debt with him. He acted as if he'd never seen such a mountainous debt. By the end of our conversation, it was clear that there were no tricks or tips for getting out from under this debt. If I really wanted to be debt free, it was going to be up to me.

Paying down Student Loan Debt

At this point I realized it wouldn't be possible to pay this back unless my salary was 3x-4x what it was currently. I knew the salary bands at Blackbaud and it wasn't going to be possible to make that kind of money there. I needed to start doing things with higher potential payoffs if I was to put a dent in my $250,000 student loan debt.

1. I started honing my skills as a full-stack developer

I knew this was one of the top paying software specialities. I figured I could at least double my salary within a few years if I got really good. This turned out to be surprisingly accurate.

The full-stack developer skills paid off immediately as I launched Wavve, and they also helped me move up the ladder at Blackbaud. By 2016 I was able to leave Blackbaud and earn $200k in from the skills I'd cultivated as a software developer.

2. I started buying nano-cap biotech stocks.

The nano-cap biotech stocks pretty much all went to zero, so that bet was a total bust. By 2016 my investments had basically dropped to zero.

3. I bought Bitcoin and Ethereum.

This paid off massively in 2017. I was able to sell for a large profit, put a down payment on a house, and knock out a quarter of my loan balance.

4. I started a software business in 2015.

The first version of this business was a complete failure. After two years of working every night and weekend, we ended up liquidating our technology in a sale for pennies on the dollar. You can read more about that experience and some of those missteps here.

Just as we were about to wind that business down, I built an internal marketing tool to help us easily convert audio to video for social media sharing. It turned out that people were willing to pay for this. At first it seemed too niche a product to generate any sort of meaningful revenue, but my business partner went ahead and tried selling with direct sales to podcasters. Determined not to make the same mistakes as with our first business, so we adopted a "money ball" approach to product development. The first version was soooo embarrassing, you could barely call it an MVP, but customers seemed willing to pay for it.

We ditched the Delaware C Corp and formed a new business entity with the goal of building a passive income business rather than optimizing for a big VC raise.

It was a long, slow grind but those hard lessons from 2015 and 2016 began to pay off. In December of 2017 we drew profits for the first time – each taking home a few thousand dollars as a holiday bonus. In 2018 growth quadrupled and were able to earn mid-5 figure incomes. By the end of 2019, my Wavve profits even eclipsed the salary from my 9-5 job. This second income stream became critical for paying down that giant mountain of student debt.

A Crazy Idea

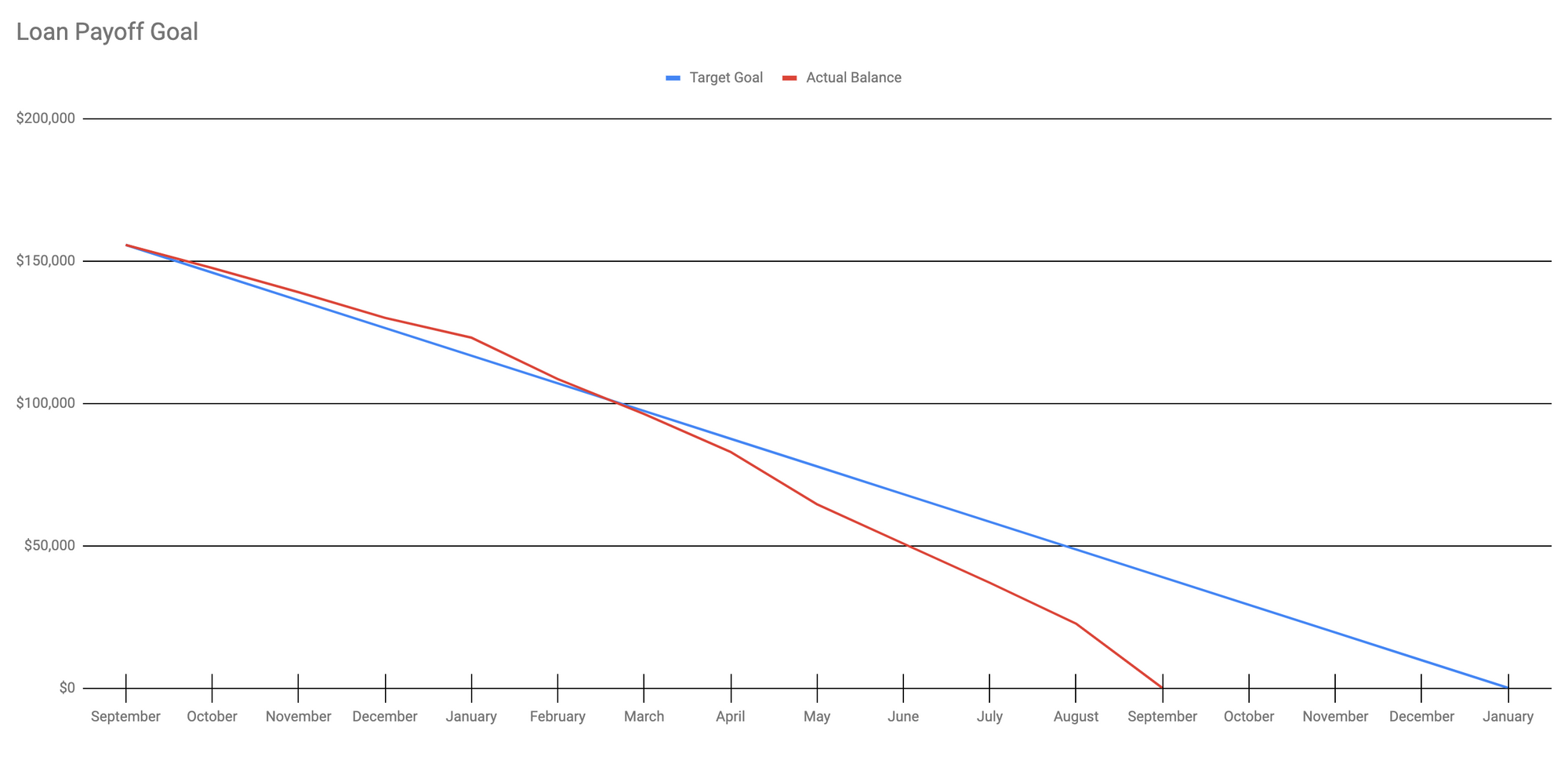

In the fall of 2018, I did something that felt absurd at the time. I set a goal of paying off my remaining $150k in student loans before the new decade. This was a full 3 years earlier than my previous ambitious goal of a 2023 payoff date. This gave me 15 months and would require over $10,000 per month.

I developed a laser focus around this goal and was hell-bent on knocking out my remaining student loans before 2020. There were months when it was extremely painful to transfer giant sums of income to payoff that debt. I listened to Dave Ramsey and other personal finance podcasts any time I was driving to stay focused on my goal.

When my Wavve income exceeded my salaried income in June of 2019, I was tempted to leave my day job, but I knew there was no way to hit my goal without two sources of income. As Wavve continued to grow and represent a larger share of my net worth, I felt more and more pressure to give it as much attention as I could muster... nights, weekends, holidays, and any other spare timeI had. As we were doing a big rewrite for Wavve last summer, I used most of my vacation days to push the release across the finish line.

It was all worth it when I zeroed out my student loans in August of 2019 – exactly 10 years after taking out that first law school loan and 4 months before my December 31st deadline. After years of feeling totally trapped and helpless, it's hard to describe the relief of suddenly being free from such a mountain of debt.

Final Thoughts

Seven years ago I had a realization. No one was coming to my rescue. Not family, not government, not the newest wave of politicians promising student loan forgiveness. I was tired of being a victim to my circumstances: bad job market, predatory student loans, dysfunctional family, etc... If I wanted freedom, I would have to pull myself out of this mess.

The experience was often lonely. For my twenties and early thirties I worked almost every night and weekend. I missed out on beach days, trips with friends, weddings, alumni events, put a home purchase on hold and delayed having children much longer than we wanted.

That said, I'm so grateful for having been through it. After pulling myself up and overcoming so much adversity, I'm confident that I can turn any situation around. If I found myself back where I started 10 years ago, I think I could do it again in 3-4 years instead of 8.

Next Steps

- Catch up on retirement. I need to keep rolling all Wavve profits into my retirement. I'm about $100k behind on retirement savings.

- Get in shape and get my abs back. 10 years of working like crazy left little time for proper nutrition or working out. I'm determined to get back in shape and get my college era six pack back.

- Start a new SaaS business to create a third income stream.