Selling Wavve

A good business should feel like something you don't want to sell. Build the dream business that you want to run, and your purchase price will reflect that.

It was January, 2019 and we'd been grinding along on Wavve for almost 4 years. After spending 18 months on a failing product, we relaunched Wavve and gradually bootstrapped our way to a healthy, profitable business. We'd just crossed $30k MRR and had no plans of selling when we received an email from someone interested in buying Wavve. They seemed serious (were represented by a broker) and wanted to learn more about the business, so we shared some basic financials and hopped on a phone call. Weeks later we received our first offer to buy Wavve. 🤯 🤯 🤯

Deal or No Deal?

If you're a bootstrapped founder and suddenly receive an offer with all those zeroes, it's extremely difficult to turn it down. The lump sum and earn out structure was extremely attractive to me at the time. I did the math and figured I could pay down my six figure student loans, catch up on retirement, and still have some money left over.

When the business you've been building suddenly has a fixed number tied to it, and there's a new fear of loss.

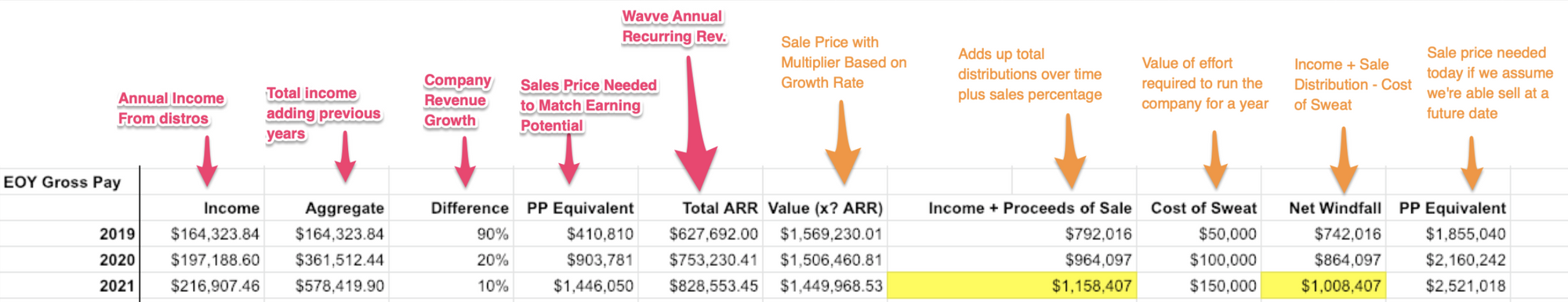

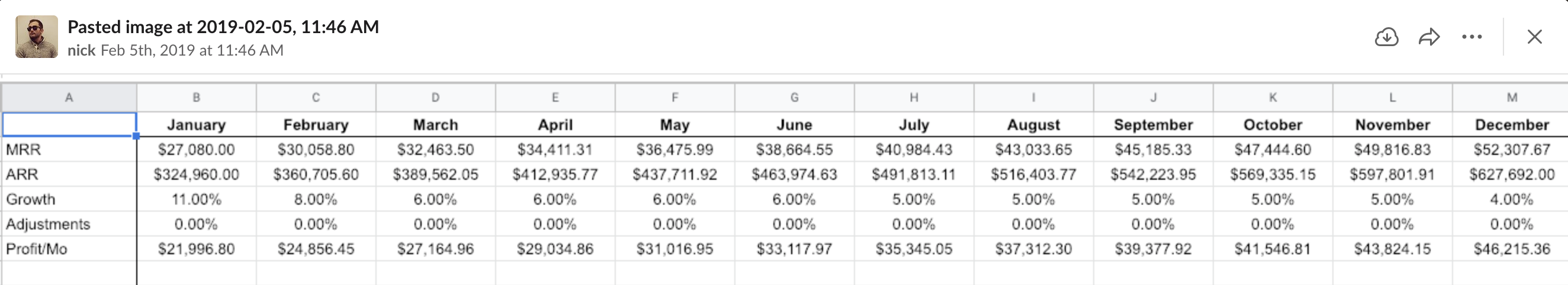

Back to where we were in early 2019: Wavve was doing just over $30k MRR, I was able to draw about $7,000 per month in profit distributions (in addition to my 9-5 salary), and the business was growing by over 10% per month. Baird and I met up and talked through our options over coffee. I built out some projections and figured out how our future cash flows compared to the acquisition offer.

Ultimately we decided to double down on Wavve for another year with the goal of growing its value to a "life changing" amount of money.

Doubling Down

I was more motivated than ever, because I knew what we'd walked away from and couldn't stomach the thought of failing now. We increased spending, hired external help, and I ramped up my hours big time.

- Launched a new complimentary product for podcasters, Wavve.link

- Baird and I went to our first podcast conference

- Invested in a branding refresh, new logo, and filed for our trademark

- Rewrote our entire infrastructure, API, and launched Wavve 3.0 web app

- Increased prices and introduced a top tier 'Pro' plan

- And most important, we got serious about fixing our churn problem

Optimizing for a Sale

One year after our first offer, we were ready to revisit the sale. It made sense logically. For me, Wavve represented 90% of my net worth and it seemed prudent to take some of that off the table. The emotional side of this decision was more complicated. I'd spent 5 years and thousands of hours building this company and presumably, we'd have no control over the future once we handed the keys over. But after spending the previous year creating, launching new features, writing lots of code, and being back in optimization mode, we were ready for something new.

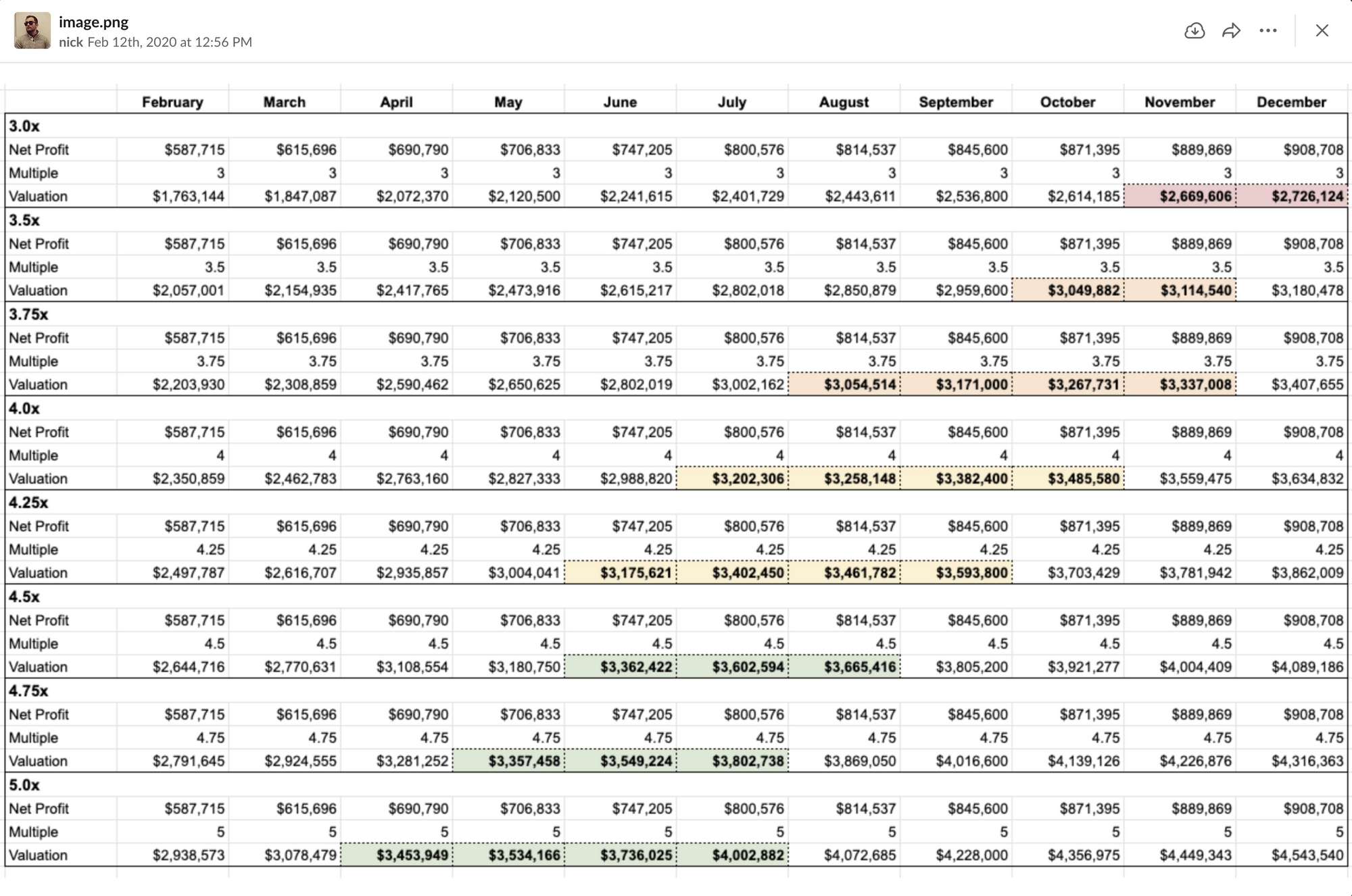

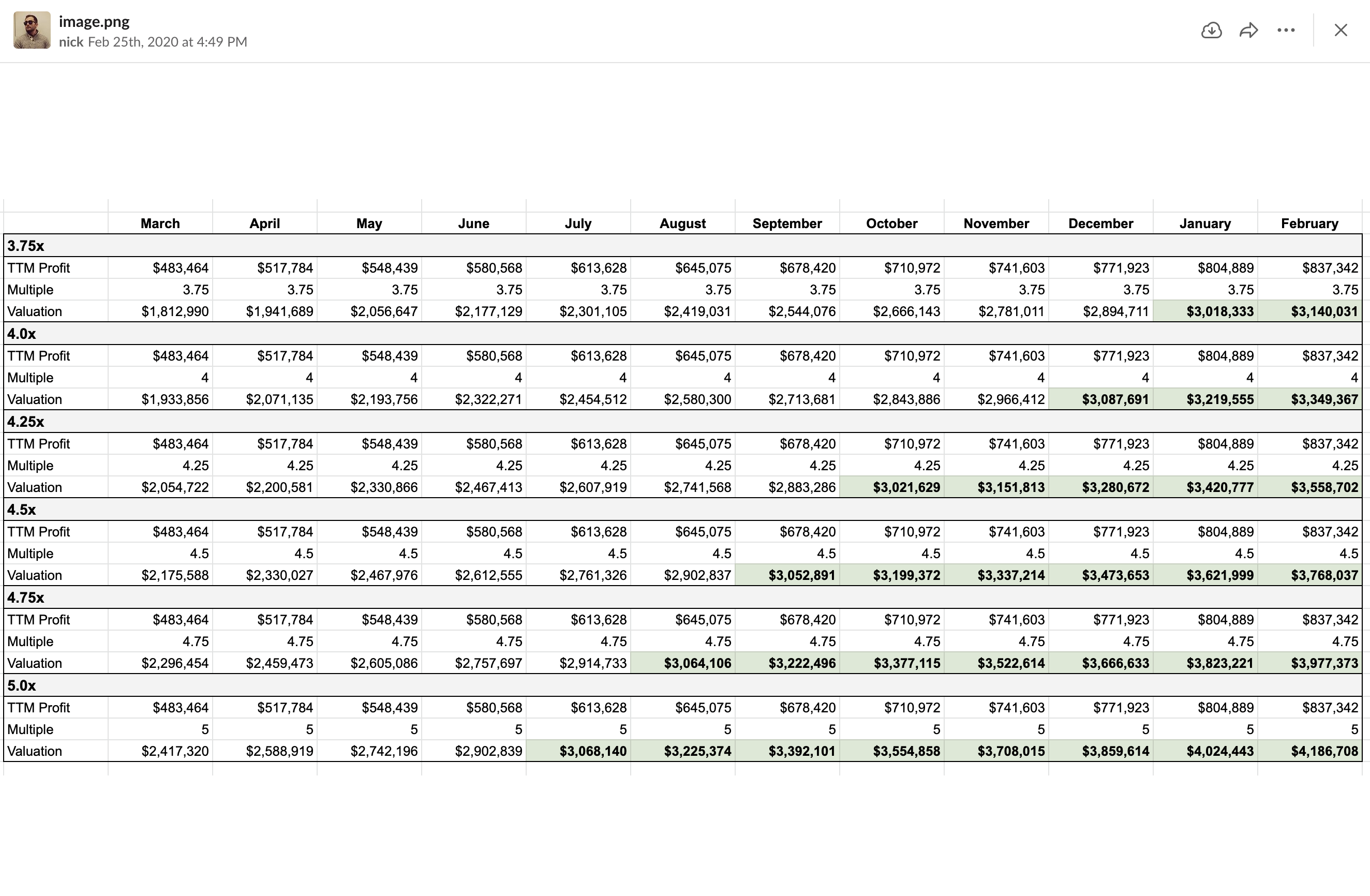

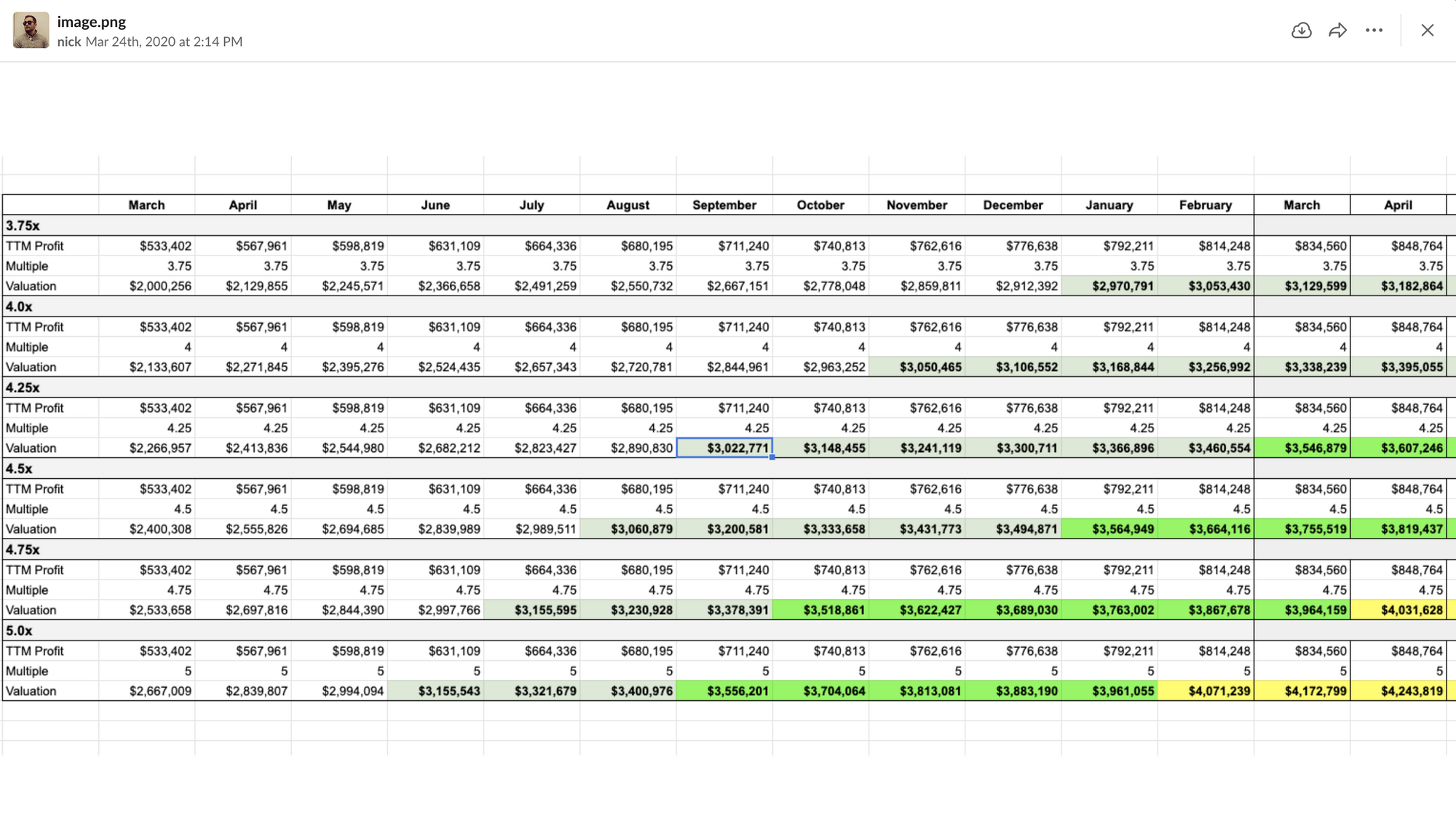

I built a valuation tracker showing acquisition ranges based on our SaaS multiple for the next 12 months. By January 2020, my projections had Wavve at about $3M, which was the minimum target we'd discussed one year earlier.

During our follow-up call with the broker, we grew more excited as it felt that a massive sale price was within reach. BUT, when the call turned to some financial nuances, I realized I'd made a pretty big error. Buyers value a company based on EBITDA or SDE using a twelve month trailing (TTM) formula. I'd just been multiplying current monthly revenue by 12. 🤦♂️

Fortunately our margins were consistently 75%-80% so our profits weren't terribly far off from the revenue based calculyion I was using. It would take about six months before TTM caught up in a meaningful way, so we planned to follow up with the broker during Q2 of 2020 with plans to list over the summer.

That call never happened. In March of 2020, the whole economy shutdown due to COVID-19. Most buyers went home and those that didn't were looking to acquire distressed businesses for a steep discount. At this point I was earning well over $20,000/ month in profit distributions, so I waa okay with the idea of just holding the business indefinitely.

We shifted our plans away from an imminent acquisition and decided to focus harder on weathering the incoming economic recession. Knowing how much of my net worth was tied to Wavve, this was a big factor in deciding to leave Casa to free up more of my time and brain space. It was a hard decision leaving one company I founded for another, but ultimately it proved to be the right call. I don't know how Jack Dorsey does it...

We were still uncertain as to how COVID and lockdowns would impact our ability to sell the business, but we were extremely grateful for healthy growth in Q2. By April, business was better than ever. From April to June we were signing up record customer numbers almost every day – a result of the shift to at-home work and huge growth in new podcasts .

We also got serious about churn. We hired a churn consultant and began working harder on our own customer cancellation flow. Whereas previously we were losing customers at a rate of 12%+ / mo, we were able to get it down to 9%/mo.

When you're planning to sell your company, few things will give you better ROI than cutting your churn rate. Churn impacts both your value multiple and has a compounding effect on your net profit over time. We saw such a massive return on investment from our work on the cancellation flow that we decided to launch a dedicated product, Churnkey. If you're a business owner looking to sell in the next 1-3 years, go ahead and get Churnkey installed today!

The Final Chapter

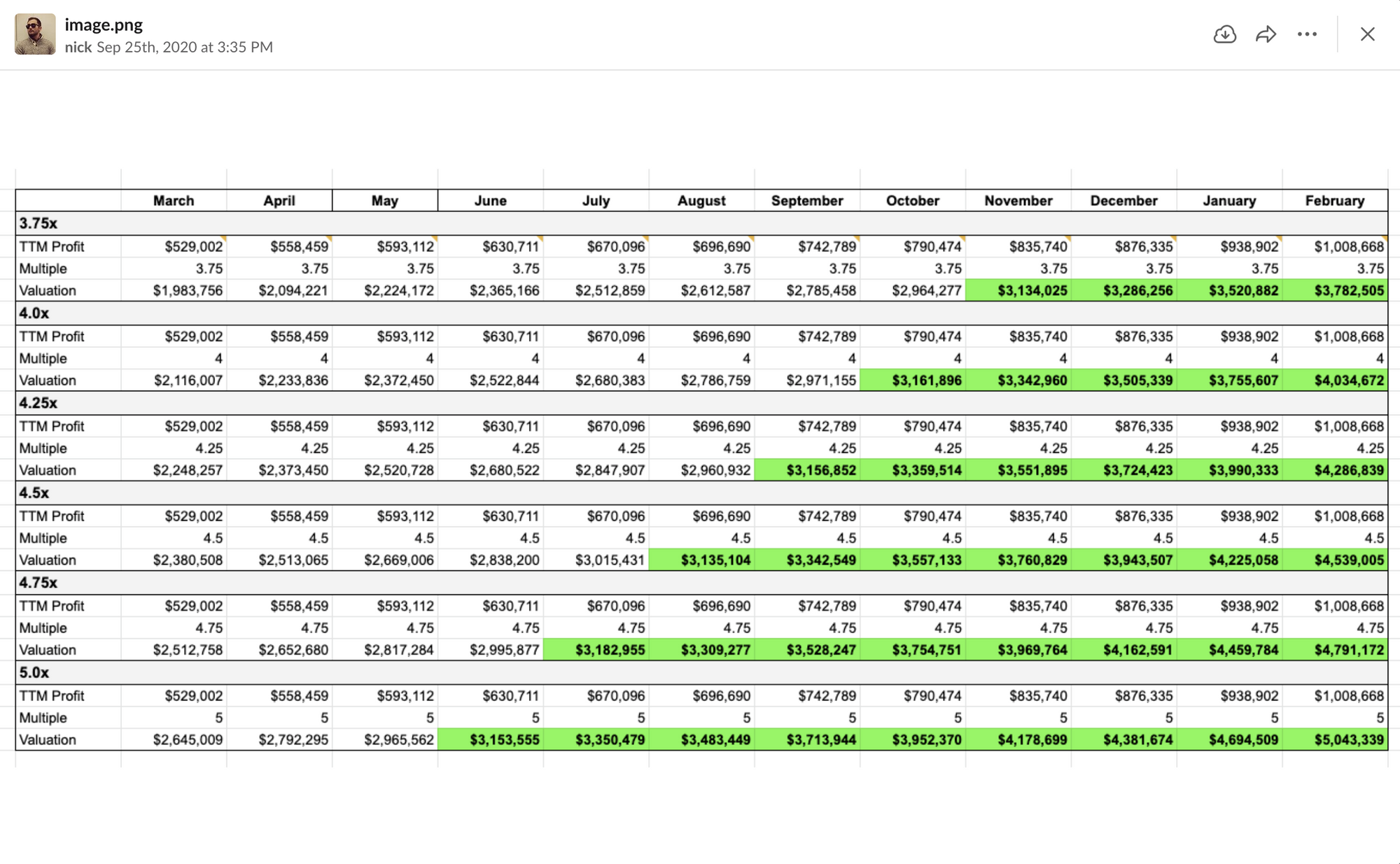

Last fall we kicked off sales discussions again with our broker. After sharing our numbers, it seemed our target price was totally attainable. We could probably list for an even higher figure.

In the two years since our first offer, we'd doubled down on growth and worked hard to build an incredible business. We'd automated business tasks, hired a dedicated support person, rewritten most of our tech stack, and weathered a global pandemic.

Now we had our very own printing press. I'll never forget waking up in Jackson Hole last October to check my Stripe notifications. I'd been totally off the grid for a few days, and I woke up to see a flurry of new customer notifications. There's really nothing like owning a business that generates so much passive income.

A good business should feel like something you don't want to sell. If you're itching to exit, buyers are going to notice that and your valuation will reflect it. Build the dream business that you want to run, and your purchase price will reflect that.

At this point we were no longer in a rush to sell the business. Even if we never sold, we knew we'd continue earning over $100,000/mo in profits for the foreseeable future 🤯.

Our decision to sell ultimately came down to what would be best for the business. By the fall of 2020, we were no longer interested in running the day to day operations and we were ready to move on to something else. We scheduled a follow up meeting with the broker for January and made plans to finalize a listing in March, 2021. But, December threw us another curveball.

First we received an inbound from a SaaS portfolio company. Then another from a private equity company. Then another potential acquirer. Then another. Then another. We spent most of December on calls with people interested in buying Wavve. I guess after a year of little to know deal-making due to the pandemic, everyone was ready to queue up acquisitions for Q1 2021.

On the day before Christmas Eve, we received 5 Letters of Intent (LOIs).

With so many options above or near our minimum price target, we decided to forgo the broker route and try to make the sale happen ourselves. I'm an attorney and typically help with any of our legal needs, but on this occasion I called in the big guns. We hired a transactional lawyer, reviewed our top deal choices, and Calm Capital was the final favorite.

Aside from a generous total deal value (with upside potential), there were a few other reasons that nudged us in Calm Capital's direction.

From the first call, Marty and David asked us about our ideal exit scenario. We gave them a number, talked about our interest in sharing some of Wavve's future upside, and we also talked about the importance that a new owner was capable of running company well. One week later, they gave us a detailed presentation that addressed all of our requirements. The deal value was right in line with our target price. They were willing to structure a deal that gave us a share of future upside. And, they planned to invest heavily in the company's future.

Apart from the actual deal terms, there were other intangibles that we liked: Culture fit. Similar way of doing business to us. Plus, David and Marty were located just a few hours drive from Charleston. We signed an LOI with Calm Capital on January 7, 2021.

After signing the LOI, it was a nerve-wracking waiting game as we went through due diligence, final sale negotiations, and planned for the asset sale. There were a few minor bumps in the road where we encountered issues we hadn't foreseen, but overall the process went smoothly. I definitely realized there's a lot of value an experienced broker can bring to the table, but in the end, we were glad to have done it ourselves. We saved a few hundred thousand dollars by not having to pay broker fees.

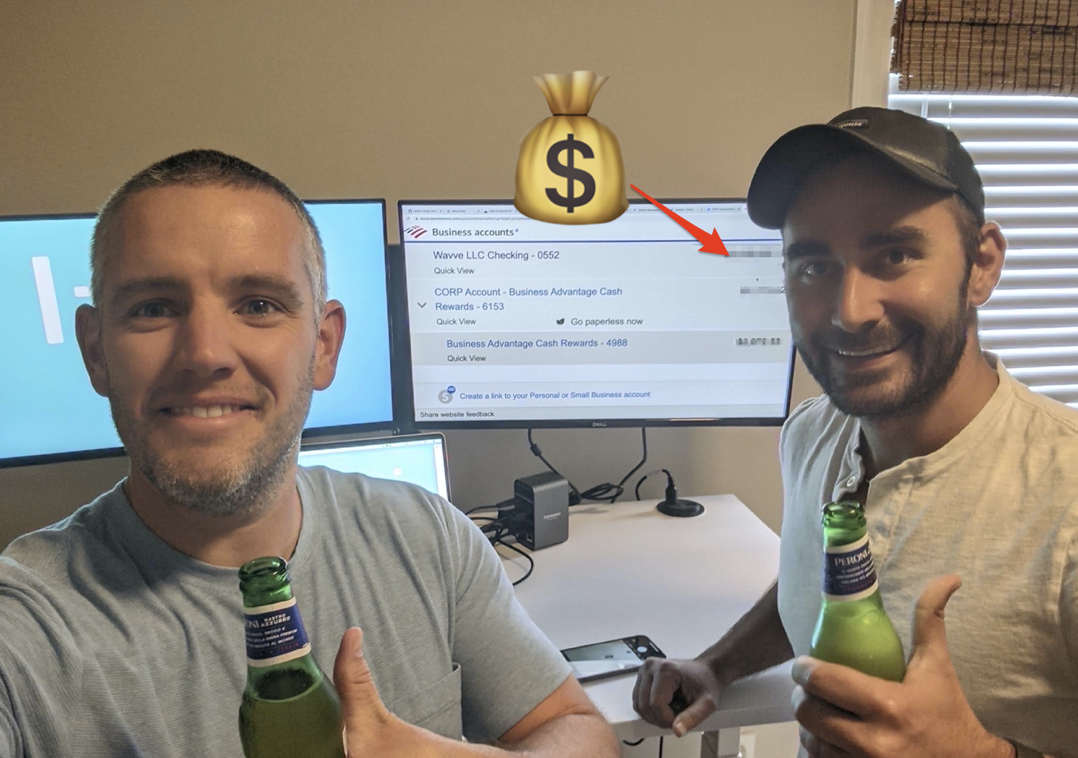

After signing the LOI, it was 83 days before the funds were in our account.

Once the wire hit our Wavve account, I spent the next few hours wiring funds to our personal accounts. Fun fact: Bank of America business accounts have a maximum 30 day transfer limit. I hit that limit after the first wire transfer. They want you to go to the bank in person before you can cross that threshold.

After closing, we took our wives for a post-sale celebratory dinner and savored in the fact that we'd sold our business for the next few days.

Going Forward

I'm sure people have a lot of questions. I'll try to answer the most common ones here:

What was the Wavve sale price?

- It was more than we dreamed, but we've decided not to disclose the exact amount or specific deal terms at this time (could change at a later date if everyone agrees). If you're someone who nerds out about SaaS valuations, you could probably make an accurate estimate.

What about Wavve?

- Wavve is in great hands. Calm Capital is committed to investing heavily in Wavve and has some exciting plans on the horizon. We've spent the last few months transitioning the new team and they already have a very capable CEO who has been running the day to day for the last month, Jeff Dolan.

Are you going to retire?

- No. I'm not sure what I'd do with myself. Currently full-time on Churnkey, spending more time with my boys, and hacking on more Bitcoin side projects.

Any advice for others?

- Yes, and I'll try to unpack some of this over the next few weeks/ months. My biggest point of advice is BE PATIENT. If you've built a strong business, time is on your side. A good business should feel like something you don't want to sell. If you're itching to exit, buyers are going to notice that and your valuation will reflect it. Build the dream business that you want to run, and your purchase price will reflect that.

Contact us / Read More:

DM me on Twitter (@nickfogle) or reach out to the former Wavve owners via email (hey@churnkey.co) for any inquiries.

Here's a personal favorite if you'd like to read more about how I went from driving a shuttle to teaching myself to code, paying off $250,000 in debt, and building Wavve.

Rob, Baird, and I have also written our official announcement over on the blog of our latest venture, Churnkey.

Last, be sure to check out these posts for different perspectives on the sale.